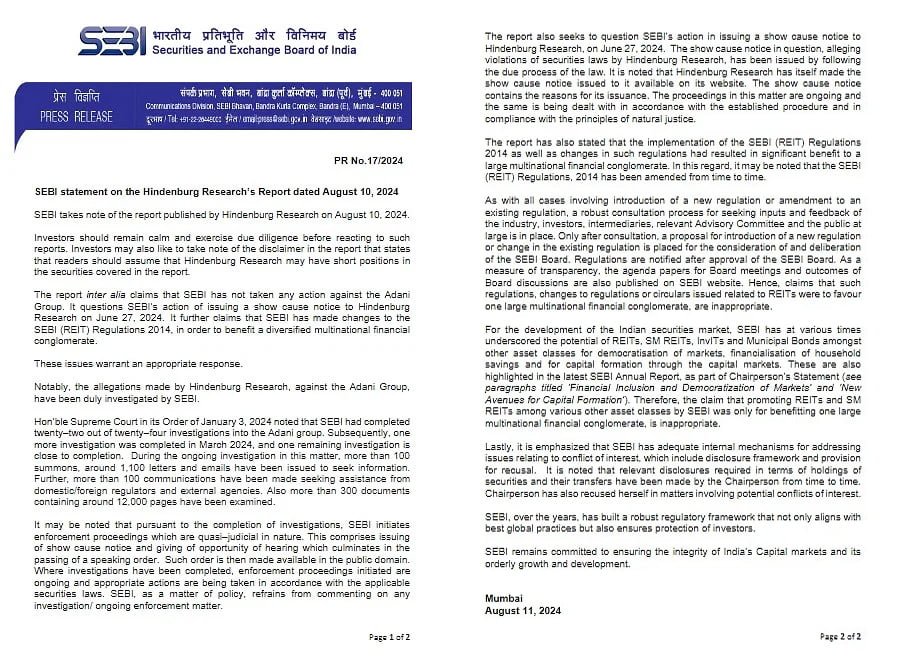

On the recent report of American short seller Hindenburg, the market regulator has said that SEBI has investigated all the allegations against Adani Group. SEBI also said it has duly investigated Hindenburg’s allegations against Adani.

The Securities and Exchange Board of India (SEBI) has reacted for the first time to the latest allegations of Hindenburg Research. The market regulator has said that chairperson Madhavi Buch has made relevant disclosures from time to time. The Chairperson had recused herself from matters involving potential conflict of interest. On the recent report of American short seller Hindenburg, SEBI has said that it has investigated all the allegations against Adani Group. SEBI said that in the cases where investigation has been completed, action has also been initiated. It is further said, ‘Sebi refrains from saying anything in any matter during the period of investigation.’

What did SEBI say in its report?

In response to the Hindenburg report, SEBI has advised investors to maintain calm and take thoughtful steps. SEBI said, ‘Investors need to remain calm. Proper preparation should be done before responding to such reports. Apart from this, investors should also pay attention to the disclaimer in the Hindenburg report.

SEBI referred to the order of the apex court

SEBI said, ‘The apex court has said in its order that SEBI has completed the investigation in 22 out of 24 cases. On January 3, 2024, the apex court had said that SEBI has completed the investigation in 22 out of 24 cases of Adani Group. SEBI further said that the investigation of one of the remaining two cases was completed in March 2024. Went. Apart from this, the investigation of one case is about to end. Let us tell you that in January 2023, Hindenburg Research had released a report targeting the Adani Group. This report created a stir, because Hindenburg had made many serious allegations against the Adani Group. In January 2024, the Supreme Court had refused to transfer to the SIT the investigation into allegations of stock price manipulation by the Adani Group. Apart from this, the top court had directed SEBI to complete its investigation in the two pending cases within three months.

Show cause notice was issued to Hindenburg

SEBI further said that on June 27 this year, a show cause notice was issued to Hindenburg for violation of securities laws. SEBI said, ‘Hindenberg Research has published the show cause notice on its website. The reasons for issuing it are given in the show cause notice. Action is going on in this matter.

What did Madhavi Buch say on Hindenburg’s report?

Let us tell you that earlier SEBI chief Madhavi Buch and her husband Dhaval Buch had termed the allegations in the Hindenburg report as baseless. He had alleged that the credibility of SEBI has been attacked by American short seller Hindenburg. Apart from this, the market regulator also said that Hindenburg’s report has made an attempt to defame the character of SEBI chief Madhavi Buch.

What was claimed in the Hindenburg report?

Let us tell you that after the Hindenburg report came out, the names of SEBI chief Madhavi Buch and her husband Dhaval Buch are being linked to the alleged Adani scam. Reports late Saturday night alleged that the couple had stakes in shadowy offshore funds used in the alleged Adani money misappropriation scam. The Hindenburg report claimed that the SEBI chairperson and her husband had stakes in offshore entities used in the Adani scam. These institutions are reportedly run by Vinod Adani, elder brother of Adani Group Chairman Gautam Adani. The report further states that these investments were made in 2015, before Madhavi Buch became a full-time member of SEBI. The report alleges that Madhavi Puri Buch transferred her shares to her husband. From April 2017 to March 2022, Madhavi Puri Buch was a member and chairperson of SEBI.